how to reduce taxable income for high earners 2020

These contributions allow you to reduce your annual. The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly.

Personal Income Tax Brackets Ontario 2020 Md Tax

But the organization lifted this limit temporarily for the 2020 and 2021 tax years.

. To reduce your reportable income you should start with maxing out your pre-tax 401k. If thats you be ready to sell some winning funds later in the year even if. According to the ATO.

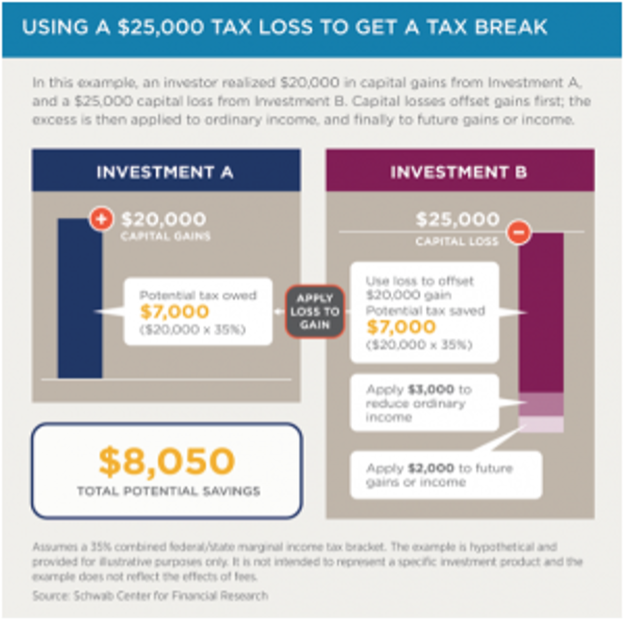

High-income earners should consider donating low cost basis stock contributing to a donor advised fund or stacking future charitable donations in a single year to maximize tax deductions. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Take precautions so that you arent d credit.

How to Reduce Taxable Income. Most employers will give you the option of a pre-tax or a Roth 401k. Income protection is tax deductible.

This credit will reduce his tax bill to zero. Now taxpayers can take a deduction of up to 100 of their adjusted gross income. Here are the Adjusted Gross Income AGI limits for claiming the Savers Credit in for filing your taxes in 2021.

Claim all the deductions you can. The government assesses a 153 Federal Insurance Contributions Act tax on all earnings to pay for the Social Security and Medicare programs. A donor-advised fund DAF is an investment account created to support charitable organizations.

At that point when assets are pulled back from the HSA they are sans tax. Typically the IRS limits deductions for charity donations to 60 of a taxpayers adjusted gross income. By setting pre-tax cash aside you bring down your taxable income and make good on less in taxes.

How to reduce taxable income for high earners through your employer benefits. Invest in retirement plans and contribute substantially. With a DAF you can make a donation receive an immediate tax deduction and then recommend grants to be given from the fund over time.

HSAs can be utilized towards any medicinally related costs for example remedies eyeglasses restorative supplies and thats only the tip of the iceberg. Fortunately there are many ways high earners can reduce the taxes on their income. Consider the credit for contributions to retirement savings which is the child tax credit.

The Retirement Savings Contributions Credit or Savers Credit offers taxpayers a credit of 10 20 or 50 of contributions to retirement savings accounts such as a 401k or an IRA. For example in 2020 we plan to deduct all of the following from our taxable income. Make changes to W-4 withholding.

Investing in these types of accounts ie. Grab a 0 tax rate on gains. Making some strategic purchases could help reduce your taxable income although dont go spending just for the sake of it and check with your accountant before you commit a large amount of money with the idea that you can write it off.

If for example you earn 70000 and take a 5000 deduction your. Bonuses that are more lucrative. It is well known that deducting your charitable contributions can reduce taxable income.

So if you rent it out to strangers you could save some taxes there. Max your pre-tax 401k. One of the best ways that you can lower your taxable income is through pre-tax retirement contributions.

Join an employer-sponsored program that gives you a financial cushion for child care and health care. One of the easiest ways to begin slashing your annual income tax bill is by contributing to a retirement account. If you are considered to be a high-income individual and have an adjusted income of more than 150000 per year and a threshold income of more than 110000 per year your annual allowance will be tapered.

How Can I Reduce My Taxable Income 2021. Just renting your house to your business for up to 14 days per year. However there are even more ways that charitable giving can provide tax relief.

Here are five tax saving tips that are easy to apply. How to Reduce Taxable Income for High-Income Earners in 2021 Max Out Your 401 k Have a Plan for Your Non-Retirement Account Assets Bunching Donor Advised Funds DAF Contribute to Your HSA. A Roth retirement account has its own benefits but it wont reduce your income this year.

By spending this money you are reducing the part of your income that is taxable by the government. Deduct Half of Your Self-Employment Taxes. The other way to reduce your taxable income is by spreading your income over multiple tax years.

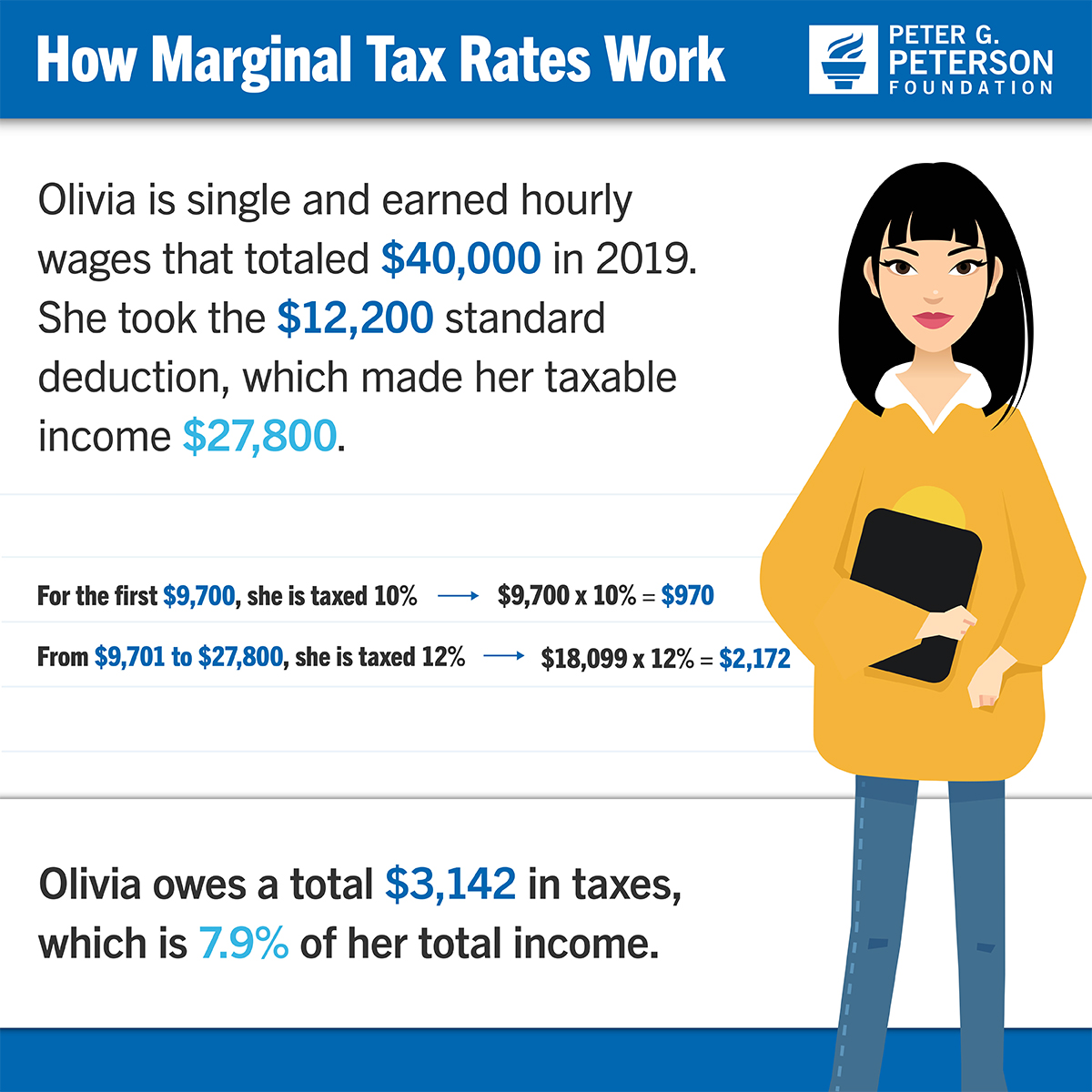

6 Tax Strategies for High Net Worth Individuals 1. Make deductions faster and defer income. People in the 10 and 15 brackets including joint filers with less than 75900 in income and singles under 37950 pay no tax on long-term capital gains.

Long-term capital gains tax rates are zero 15 percent and 20 percent for 2018 depending on your income. 5 Tax Strategies For High Income Earners 1 Invest in retirement accounts. 401k and 403b helps in that every dollar you put in is not taxed until you take it out.

Tax law can be complex. You have to pay for the FSA. As you know a tax deduction shrinks your tax bill by shrinking your taxable income.

You can deduct the amount you contribute to a tax-qualified retirement account from your income taxes except. There are many strategies to help you maximize your charitable contributions and reduce your income tax. For 201920 the annual pension contribution limit for tax relief purposes is 100 of your salary or 40000 whichever is lower.

Make a donation to charity Ensure your retirement is as healthy as possible. This means that you will be in a lower tax bracket for both years and theoretically pay less tax. An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account IRA.

One of best ways for high earners to save on taxes is to establish and fund retirement accounts. Sell short at the highest price. Federal tax brackets on wages go from 10 percent for the lowest earner to 37 percent for.

What Are 3 Ways You Can Lower Your Taxable Income. Regardless of how you use it though maxing out contributions will lower your taxable income this year providing an opportunity to decrease tax burdens. In Georgia however the deduction is.

Keep careful records on this one but basically youre allowed to rent your house out to anyone you like including your own business without paying taxes on that rental income.

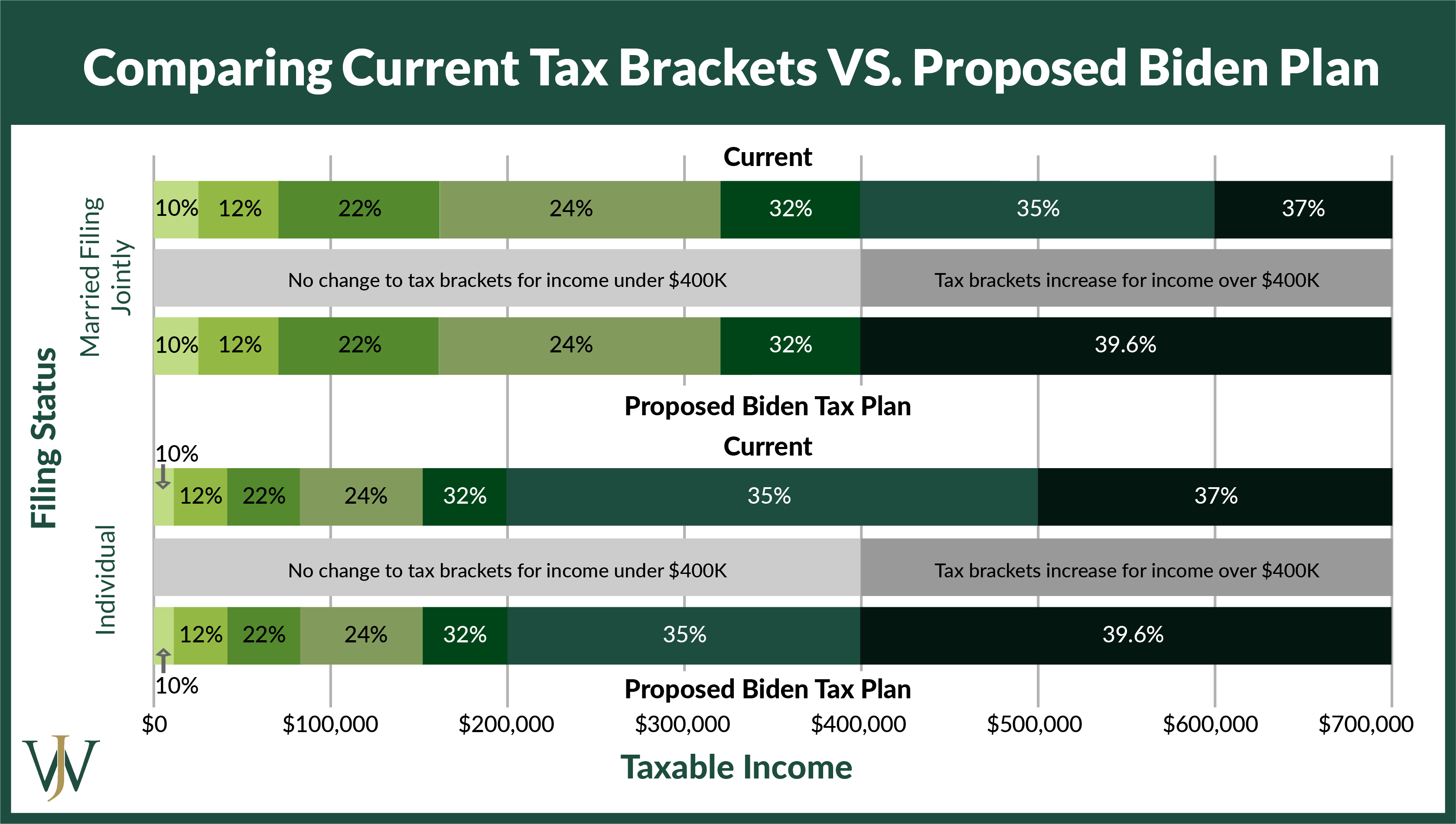

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

Tax Strategies For High Income Earners Wiser Wealth Management

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How To Reduce Taxable Income In 2021 Youtube

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Here S A Breakdown Of The New Income Tax Changes Capstone Cpas

How Is Taxable Income Calculated

6 Strategies To Reduce Taxable Income For High Earners

How Do Marginal Income Tax Rates Work And What If We Increased Them

What Is Taxable Income And How To Calculate It Forbes Advisor

What Is Taxable Income With Examples Thestreet

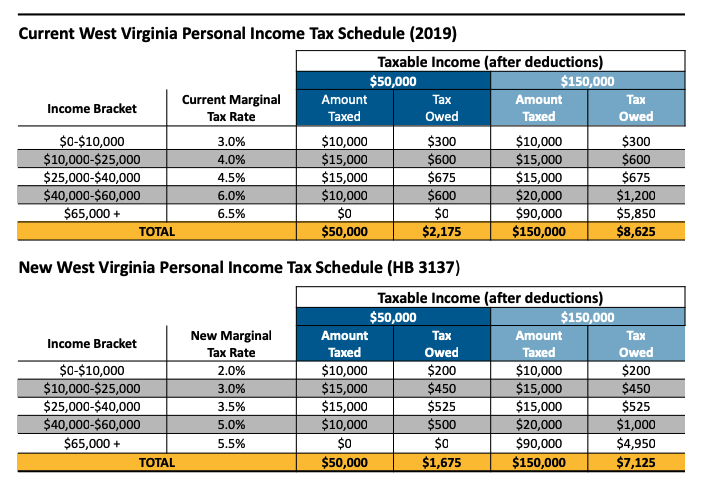

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 West Virginia Center On Budget Policy

How Do 401 K Tax Deductions Work

The 4 Tax Strategies For High Income Earners You Should Bookmark

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)